HARVESTATE AM is an independent, Paris-based investment and asset management company, dedicated to real estate investments and accredited by the Autorité des Marchés Financiers (AMF, the French securities market regulator) as an alternative investment fund manager, under the AIFM directive.

HARVESTATE AM enjoys a strong expertise in the real estate markets of Paris and its surrounding region and is active across the spectrum of the real estate assets classes: from Core/Core + to Value-Add and Speculative investments.

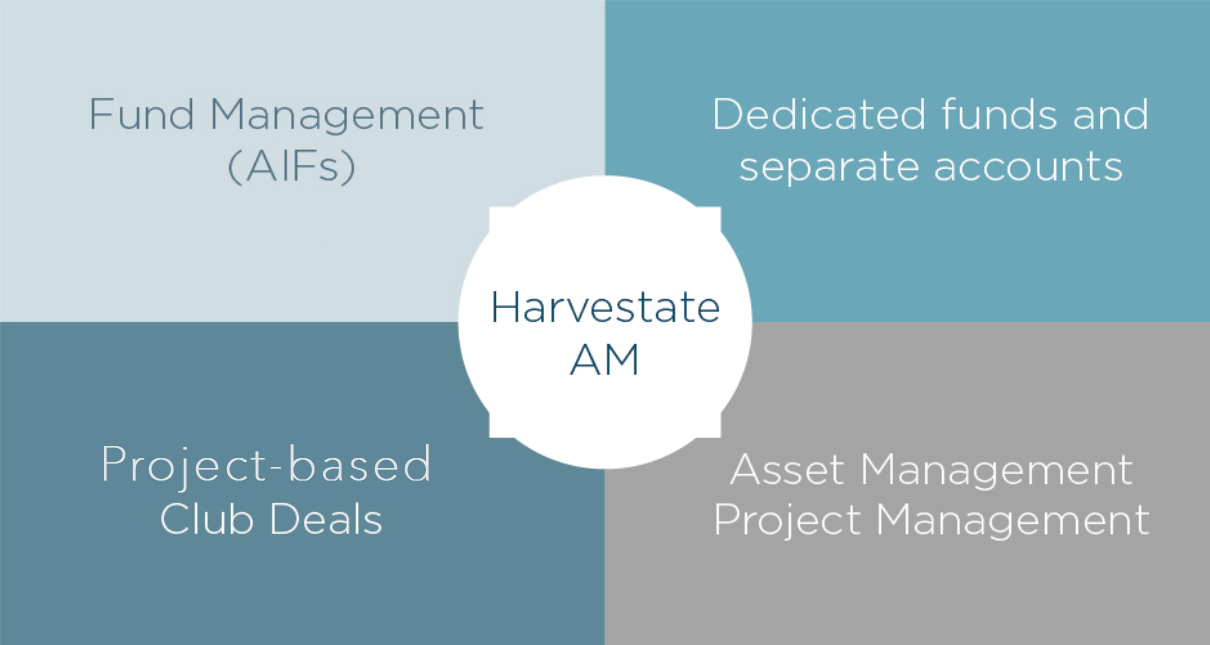

With its team of 12 experienced professionals, covering all areas of expertise, the company offers a wide range of services to its professional clients (French and foreign institutional investors, family offices and other qualified investors), particularly in the management of funds and real estate investment vehicles and asset management. Harvestate Asset Management is active in the following areas:

Formerly known as Nexity REIM, HARVESTATE AM used to be the real estate investment management and asset management division of Nexity, France’s leading fully-integrated real estate company (2022 revenue: €4.7 bn). Between 2006 and 2014, we acquired a solid reputation for our asset management services and for setting up club deals in the value-added and opportunistic commercial property sectors.

The company became independent following a spin-off carried out in June 2014 by Laurent Diot, former CFO of Nexity. The company’s capital is held by its management, and it is totally independent of any property developer, operator or investor.

Our cross-disciplinary team of experienced professionals combines an intimate knowledge of real estate value drivers, a strong sense of creativity drawn from backgrounds in property development, and a meticulous approach to financial and operational

First and foremost, HARVESTATE AM strives to build long-lasting relationship with its clients, based on trust, a fair and transparent fee structure and a true alignment of interests between Investment Manager and Investors.

Throughout the investment process, we employ a rigorous risk-control system, with attention to minute details during both the due diligence and execution phases.

We adapt to our clients’ needs, offering customised reporting for each investor’s needs.

With an average above 25 years of experience in real estate, HARVESTATE AM’s seasoned managers have a vast network of investors, property owners, brokers, investment bankers and commercial bankers to draw on for first-rate deal sourcing and financing.

HARVESTATE AM is a member of ASPIM (a French association of regulated real estate investment companies), OID (Encourage Sustainable Property, an independent French association made up of private and public commercial real estate professionals, whose aim is to promote sustainable development in the property sector) and IEIF (a French property investment research institute).

![]()

![]()

![]()